Samuel Zell in the podcast “Leading Voices in Real Estate”

I pretty much just found this person, Sam Zell and started watching videos and podcast of him. I think he's definitely a interesting person that fits this blog.

His origin (parents) is from Poland, but he was born in the States. He's like me, doesn't like to work for somebody else. He has used his curiosity and mind to find opportunities along the way. He always look at the risk side.

Approximately 70 percent of the time he says he needs to be right in his decision, and the risk can not be too severe.

He worked as a attorney for 4 days. Being employed.

3.00 “A lot of people ask me when I’m going to retire. And I answering them by saying that “retire from what?” I really worked 4 days in my life for somebody else. I had a define work that were limited to those 4 days. And the rest of the time I’ve been chasing ideas and testing my limits. And my comment there is very much from a function of that. I believe that you constantly test your limits. And the day you stop testing your limits. The day you say, “I’m satisfied” or “I’ve reached my goals” That’s a pretty sad day. It’s a pretty limiting definition of who you are. So, what I’ve tried to do my selves for those I hope to inspire. I try to reinforce for them the importance of constantly readjusting their goals. Never getting too close to success. The real thrill is climbing the latter, not sitting at the top.” – Samuel Zell, (Leading Voices in Real Estate)

Chasing deals and hustling business

"But I am not solely, or even primarily, motivated by the accumulation of wealth. There’s a line from an old movie, Wheeler Dealers: “You don’t go wheeling and dealing for the money, you do it for fun. Money’s just a way of keeping score.” And that’s how I see it. I’ve always been much more drawn to the experience. My life is about testing my limits—and having fun in the process. I believe that 1 + 1 can equal 3. Or 4. Or 6. The fun and gratification are in figuring out how. For me, business is not a battle to be waged—it’s a puzzle to be solved." - Sam Zell, (Am I Being Too Subtle?, 2017)

Why do it if it's not fun?

"Back in 1985, the Wall Street Journal did a front-page story on me and quoted me saying “If it ain’t fun, we don’t do it.” The next day I walked into the office and all the mailroom guys were wearing T-shirts with that quote. I loved the fact that they thought to do it, that they felt they could, and that they made it happen. That epitomizes the culture at my investment firm, Equity Group Investments (EGI)." - Sam Zell, (p.15,3 / 406), (Am I Being Too Subtle?, 2017)

Last minute train..The daddy that saved them from the holocausts..

6.30 “My dad was on the last train at 4.30 in the afternoon on august 31, 1939 going east. And the Luftwaffe bombed the railyard with the start of World War 2 in September first.” – Samuel Zell, (Leading Voices in Real Estate)

"I am the son of Jewish immigrants who fled Poland to escape the Holocaust and come to the United States." - Sam Zell, (p.15,3 / 406), (Am I Being Too Subtle?, 2017)

The importance of being close to the truth and knowledge in order to make the right decision. The importance of being able to interpret the reality and take decisions, not just thinking about them.

Risk benefits ratio

"My father, Bernard, bought and sold grain throughout Eastern Europe. By virtue of traveling to different countries and interfacing with different people and cultures, he had a more worldly perspective and was more attuned to geopolitics than most of his family and neighbors. He was also an avid follower of current events and relied on his shortwave radio for news, since radio in Poland was censored. He and my mother listened to reports in different languages, including reports from Germany, Britain, and America. So he was very aware of the growing danger for Jews in Poland at a time when many of his more provincial friends and family dismissed the possibility of extreme scenarios." - Sam Zell, (p.18 / 406)(Am I Being Too Subtle?, 2017)

“There was no place west. West wasn’t an option at that stage. So, the only option was east. As opposed to many others once he began the process, he was never going to stop short of getting to America. There was a lot of times when my mother describes saying “Alright, enough, we’re 1000 miles from the front or whatever and he just was determined the future was America and that where he had to come to.” – Sam Zell, (Leading Voices in Real Estate)

“There was a lot of Jewish refugees in Tokyo in 1940 and the early parts of 41. And most of them were trying to get Visas to the United States. As a result the U.S. embassy in Tokyo was a mess. He basically concluded that what he needed to do was to go to Kobe, which was not to far away where there was another embassy. Where nobody was there. It kind of follows the thesis of my book, which is competition is great for other people, but when you wanna get something done, the less competition you have the better. And that’s how he got out. Most of the rest of the refugees ended up spending the war in Shanghai, which is where the Japanese deported them to.” – Sam Zell, (Leading Voices in Real Estate)

“Frankly, there’s no substitute for limited competition. You can be a genius, but if there’s a lot of competition, it won’t matter. I jokingly tell people that competition is great — for you. Me, I’d rather have a natural monopoly, and if I can’t get that, I’ll take an oligopoly.” Book: Am I Being Too Subtle — Sam Zell

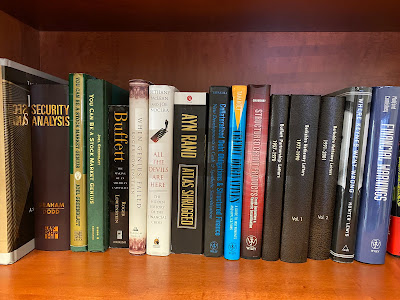

By the way, Ayn Rand writes about Ivar Kreuger who also believed in trying to limit competition

This is from the book: Night of January 16th, Ayn Rand

"In fact, Ivar Kreuger was a man of unusual ability who had, at first, made a fortune by legitimate means; it was his venture into politics -- mixed-economy politics -- that destroyed him. Seeking a world monopoly for his match industry, he began to give large loans to various European governments in exchange for a monopoly status in their countries -- loans which were not repaid, which he could not collect and which led him to a fantastic juggling of his assets and bookkeeping in order to conceal his losses. In the final analysis, it was not Kreuger who profiteered on the ruin of the investors he had swindled; the profiteers were sundry European governments. (But when governments pursue such policies, it is not called a swindle: it is called "deficit financing.")" - Introduction, Night of January 16th, Ayn Rand

United States is the land which has some good founding rules coming from the grounding fathers, the constitution. Back to Sam. He was born 90 days after his parents came to the United States. Sam keeps talking about his father:

9.00 ”For me it was growing up in a truly immigrant household. An immigrant that maybe is different from today’s immigrant, I don’t know. But he’s attitude was that he was the luckiest guy in the world. That he had got this extraordinary opportunity to come to the United States and start over again. The benefit from the enormous land of opportunity. He used to refer to it as the streets are paved with gold. From his perspectives and he therefore influenced me. There was just an enormous appreciation for the American people, the American system. How lucky we were to be able to recreate our lives in this environment.” – Samuel Zell, (Leading Voices in Real Estate)

The U.S. constitution stipulates among other things The First Amendment that protects the freedom of speech, religion and the press. It also protects the right to peaceful protest and to petition the government. The amendment was adopted in 1791 by some really smart persons.

“Our new Constitution is now established, everything seems to promise it will be durable; but, in this world, nothing is certain except death and taxes,” Franklin said.

By the way, the smart Benjamin Franklin is the only Founding Father to have signed all four of the key documents establishing the United States.

The Swedish constitution also have the Freedom of the Press Act and the Fundamental Law on Freedom of Expression. But we always have to fight against the ignorant people who dont understand how important this is. And cancel culture is also a big problem.

Sam continues talk about his father.

”He must have told me a hundred times how lucky I was that I was born in the United States. How the street of the United States were paved with gold, not monetary gold, but freedom. And that was really what it all meant to him. He over and over again lectured me on how important it was to understand how unique experience it was to live in a country where you really had the freedom to make decisions. You had the freedom to work harder or work less. Or change professions or do whatever it is you want to do as long as you didn't disturb your neighbor. So this was an extraordinary background for everything that eventually happened to me. And without question very much influenced how I made decision going forward. Cause more than anything else what he told me was that anything was possible. That you didnt start with a set of limitations, you start with an entire spectrum was available, how good you are, how committed you were, how hard you were willing to work that really was the limiting factor. Not the society.” – Sam Zell, 24 min, #407 Tim Ferriss Show

"I recognized a need common in all 13-year-old boys, saw a restriction on supply and I took advantage of it," says Zell with a laugh. "Fifty-odd years later I'm still doing the same thing." (Investment Zen, Forbes, 2013)

"Since I was a twelve-year-old who spent afternoons exploring the streets of Chicago alone, I’ve been hungry for new experiences. So I’ve never understood the traditionally strict boundary between “work” and “fun.” If I’m being intellectually challenged, if I’m doing things I’ve never done before, if I’m using my creativity and resources to solve problems, if I’m constantly learning—that is fun." - Sam Zell, (Am I Being Too Subtle?, 2017)

12.00 ”At the time I called it naked women. Later on when I describing the situation with more sophistication. It was much easier to decide that I had recognized an unfulfilled part of the market. I also recognized where there was innate demand. I recognized the fact that artificial government regulation had prohibited the magazine from being sold where I lived. But what available below the train tracks. So, you could say that I converted what was pretty instinctual when it started.

I bought this thing, I liked it, I read it and then I showed it to a friend of mine, and he said, “Wow how do I get one of those?”. And so, we began a business”. [. . .]” I remember sitting there thinking about what the margin should be, it cost 50 cent, I ended up coming up with 3 bucks.”[. . .]” How much in absolute terms could I get and still make it not a major event for someone to participate. I also probably figured that if I got one guy to buy, I’m gonna get a lot of guys to buy. And if I got one guy to set the price and he was happy with it that was kind of a validation that’s what gonna make the business work. Demand was unlimited.” – Samuel Zell, (Leading Voices in Real Estate)

"The true test of an entrepreneur is someone who spends his life constantly testing his limits.” – Sam Zell"The definition of an idiot is someone who has reached their goals." – Sam Zell"I don't do business with anybody who's not afraid, and I won't hire anybody who is confident to the point where fear is not very close to the surface. I've often said that fear and courage are cousins and very closely related." – Sam Zell

"In 2007, Sam Zell, the billionaire Chicago investor, sold a portfolio of 573 properties he had assembled over three decades, Equity Office Properties Trust, to the Blackstone Group for $39 billion. It was the largest private equity deal in history, but Blackstone did not stop there: it immediately flipped hundreds of the buildings for $27 billion.Today, the wreckage of those purchases is strewn across the country, from Southern California to Austin, Tex., to Chicago to New York. Many of the 16 companies that bought Equity Office buildings are now stuck with punishing debt, properties whose values are plummeting and millions of feet of office space they cannot fill.Few deals better exemplify the excesses of the commercial real estate boom than the dismemberment of the Equity Office empire, and fewer still better underscore their bitter consequences." (Bagli C. V., 2009)

”I think my attitude is that last time I checked my neck didn’t turn all the way around. So, I have therefore never spent much time trying to look back and I spend all my time trying to look forward.” – Sam Zell, (19.00 building Equity Group Investments)

Episode: Sam Zell | Founder & Chairman of Equity International (Rebroadcast)

(2018-12-17), Website: https://www.podbean.com/site/EpisodeDownload/DIR1034A73A3YQPH

Brennan M. (sept. 2013). The Investment Zen Of Sam Zell: Inside The Grave Dancer's $4 Billion Business Empire. Forbes. Website: https://www.forbes.com/sites/morganbrennan/2013/09/18/the-zen-of-sam-zell-inside-the-grave-dancers-4-billion-business-empire/

Bagli C. V. (Feb. 6, 2009). Sam Zell’s Empire, Underwater in a Big Way. New York Times. Website: https://www.nytimes.com/2009/02/07/business/07properties.html

Trinity SMF Podcast [Podcast], (april 2022). Sam Zell on building Equity Group Investments. Website: https://www.podbean.com/site/EpisodeDownload/DIR136D174CHA2AC

No comments:

Post a Comment